Overview

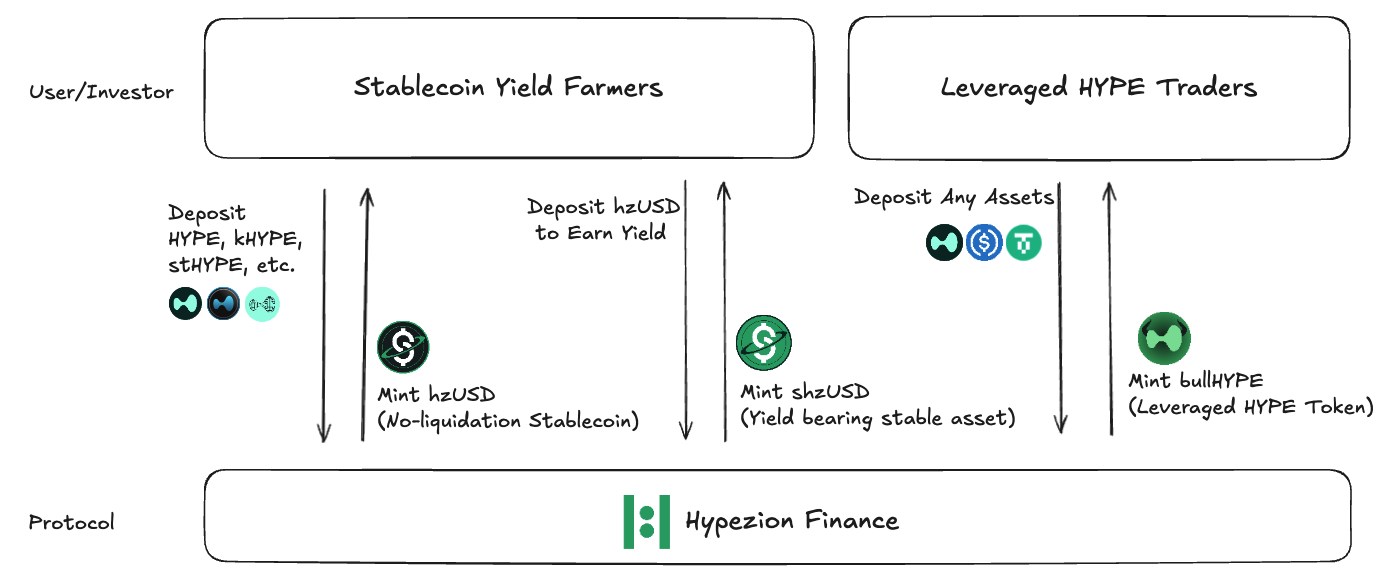

Hypezion Finance is a protocol that integrates stability, yield, and leverage into a unified structural system.

Core Concept

Hypezion Finance is a protocol that unifies a collateral-backed stablecoin (hzUSD), a yield-bearing receipt token (shzUSD), and leveraged market exposure (bullHYPE) into a single, coherent financial system.

Rather than treating stability, yield, and leverage as separate products, Hypezion Finance designs them as complementary layers. Stablecoin holders earn sustainable yield generated by system activity, while traders access leveraged exposure through protocol-managed structures without relying on margin calls and liquidations.

By embedding stability and leverage directly into its core architecture, Hypezion Finance aims to redefine how capital efficiency, risk management, and long-term sustainability are achieved in on-chain finance.

Token System

| Token | Description | Use Case |

|---|---|---|

| hzUSD | No-liquidation stablecoin designed to maintain a peg around 1.00. | Base asset for exchange, yield generation, and collateral redemption |

| shzUSD | Yield-bearing share token received by depositing hzUSD into the Stability Pool. | Yield accrual and participation in redistribution |

| bullHYPE | Provides structural leveraged exposure to HYPE. | Long-term long positions and leveraged investment |

Through structural design, each token operates independently while maintaining circular and complementary relationships that support stability and returns.

Design Philosophy

1. No Liquidation Architecture

Hypezion Finance adopts a no-liquidation structure that eliminates user-level liquidations.

Collateral risk is absorbed and redistributed at the system level, ensuring that individual positions are never forcibly liquidated.

2. Structural Yield

Yield is not simply interest, but is designed as a reward proportional to each participant's contribution to system-wide stability. This establishes a circular structure of "yield for stability."

3. Perpetual Leverage without Funding

Holding bullHYPE incurs no funding costs or margin requirements.

Typically, leverage positions require ongoing costs such as funding rates and margin that increase over time, particularly for long-term holders.

In Hypezion Finance, leverage is structurally perpetuated through bullHYPE ownership, eliminating time-based costs and thereby resolving the "Frictions of Time" inherent in DeFi.

Comparison to Existing Models

| Aspect | Traditional Stablecoins (CDP) | Hypezion Finance (Structural) |

|---|---|---|

| Collateral Model | Individual overcollateralization | Structural pool collateral |

| Liquidation | Yes (when LTV exceeded) | None (in-pool rebalancing) |

| Yield Source | Borrowing interest | Pool yield and arbitrage fees |

| Peg Mechanism | Oracle-centric | Arbitrage, fees, and queue mechanism |

| Leverage | Borrowing-based | Structural token-based (bullHYPE) |

Hypezion Finance achieves the coexistence of stability and efficiency. It defines a world without liquidations or funding through its structural foundation.

Next Steps — How to Start

To use Hypezion Finance, begin with one of the following routes based on your objective:

- Buy hzUSD — Acquire the stablecoin

- Earn Yield with hzUSD (shzUSD) — Deposit to earn yield

- Buy Leveraged HYPE Tokens (bullHYPE) — Acquire leveraged derivative assets

- Redeem to Collateral (hzUSD → HYPE) — Convert stablecoin back to collateral

Each process is detailed in the How to Start section.

Summary

- Hypezion Finance is a DeFi protocol that integrates stability (hzUSD), yield (shzUSD), and leverage (bullHYPE) into a single circular structure.

- Adopts a Structural Finance Model without liquidations or funding costs.

- All operations are on-chain, transparent, and reproducible.

Hypezion Finance — Stability without Liquidation. Leverage without Funding.