Hyper Stability Module

The Hyper Stability Module is the stability control layer of Hypezion Finance. It monitors system-wide health in real-time and automatically adjusts operations such as issuance volume, redemption speed, and fees as needed.

This module switches the protocol's state based on the Coverage Ratio (CR), applying different fee settings for each zone to realize a self-stabilizing mechanism even within a no-liquidation structure.

1. System Zones Overview

Hypezion Finance operates in three distinct zones based on Coverage Ratio:

These zones transition automatically based on the Coverage Ratio, with each change recorded as on-chain events.

2. Key Monitoring Indicators (Ratios)

(1) Coverage Ratio (CR)

- Core indicator showing system-wide collateral health.

- Determines the current system zone and fee structure.

- Calculated using available reserves plus locked kHYPE pending redemptions.

(2) Buffer Ratio (BR)

- Indicator representing residual collateral proportion, directly linked to bullHYPE risk tolerance.

- When declining, bullHYPE issuance is restricted and shzUSD reward ratio increases.

(3) Peg Deviation (PD)

- Deviation rate showing how far hzUSD market price is from the peg ($1).

- When PD exceeds threshold, fees and caps are dynamically adjusted.

(4) Oracle Confidence (OC)

- Indicator measuring agreement between oracles.

- The OracleAggregator uses weighted median from multiple sources (HyperCore, Pyth, RedStone, Chainlink).

(5) Utilization (U)

- Utilization rate against hzUSD issuance cap.

- If too high, fees automatically increase and Mint suppression is applied.

3. Zone Transition Logic

Zones automatically change based on the Coverage Ratio (CR):

Healthy → Cautious

- When CR declines below 150%

- Fees reduced to encourage redemptions and restore CR

Cautious → Critical

- When CR falls below 130%

- Stability Pool intervention (

triggerIntervention) becomes available - Protocol converts hzUSD from Stability Pool to bullHYPE to reduce liabilities

- Fees shift to discourage hzUSD issuance (higher mint fee, zero redeem fee) while encouraging bullHYPE deposits (zero mint fee)

Recovery Path

- When CR recovers above 150%, protocol can call

exitRecoveryMode - Converts bullHYPE back to hzUSD, restoring normal Stability Pool composition

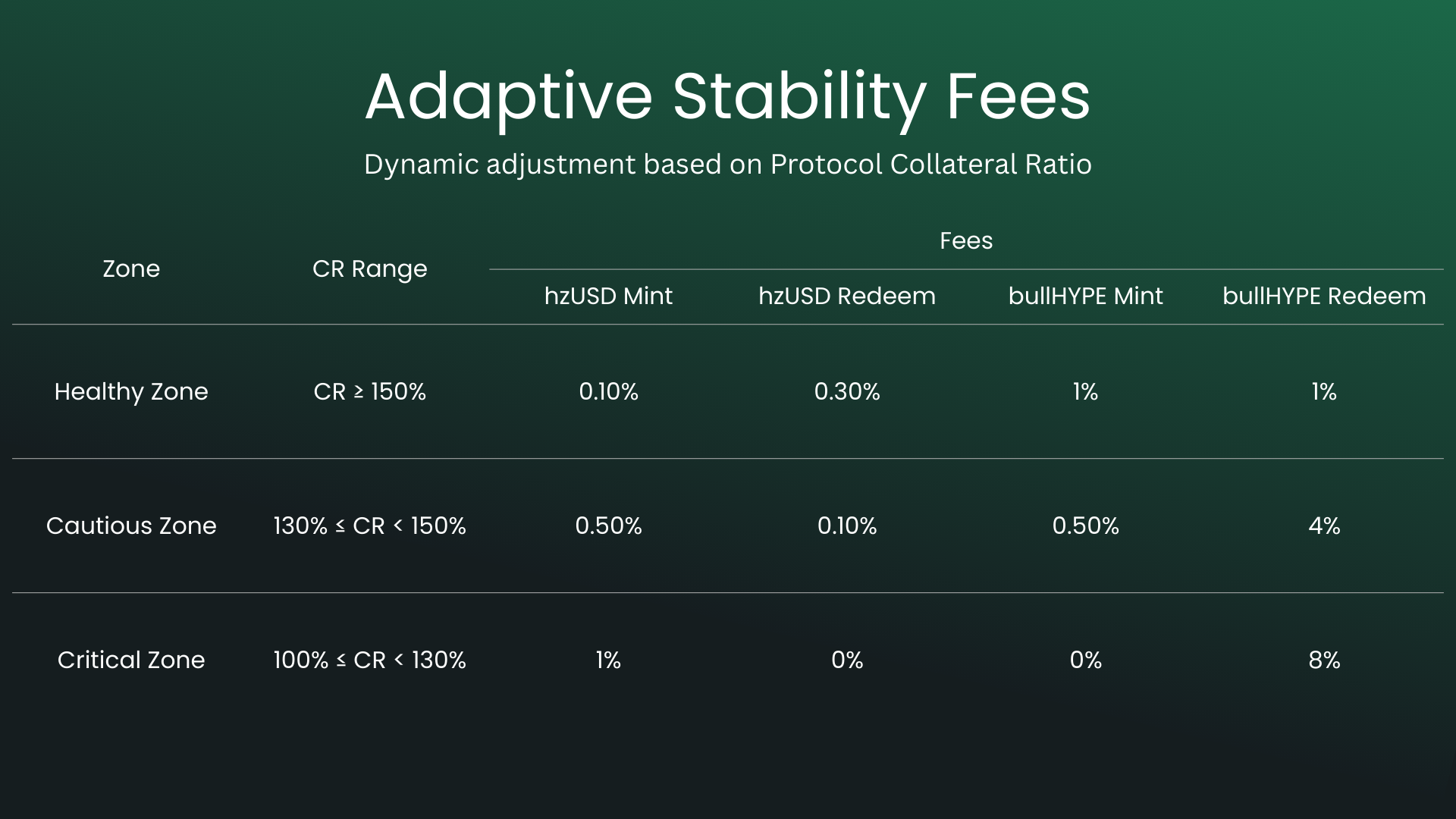

4. Dynamic Fee Model

Fees are dynamically determined based on system zone (token-specific structure):

hzUSD Fee Structure

| Zone | CR Range | Mint Fee | Redeem Fee | Rationale |

|---|---|---|---|---|

| Healthy | ≥ 150% | 0.1% | 0.3% | Standard operation, sustainable fees |

| Cautious | 130% - 150% | 0.5% | 0.1% | Higher mint fee discourages issuance, lower redeem fee encourages redemptions |

| Critical | 100% - 130% | 1% | 0% | Maximum mint fee, zero redeem fee to maximize redemptions |

bullHYPE Fee Structure

| Zone | CR Range | Mint Fee | Redeem Fee | Rationale |

|---|---|---|---|---|

| Healthy | ≥ 150% | 1% | 1% | Standard operation, sustainable fees |

| Cautious | 130% - 150% | 0.5% | 4% | Lower mint fee encourages issuance, higher redeem fee discourages redemptions |

| Critical | 100% - 130% | 0% | 8% | Zero mint fee to maximize deposits, high redeem fee protects collateral |

Key Design Principle: Token-specific fees create balanced incentives:

- hzUSD: Higher mint fees in Critical Zone discourage issuance, while zero redeem fees encourage redemptions to restore CR

- bullHYPE: Lower/zero mint fees in Critical Zone encourage new deposits to increase collateral, while high redeem fees protect existing collateral

5. Stability Pool Intervention

When CR falls below 130% (Critical Zone), the protocol can trigger an intervention:

triggerIntervention() Function:

- Calculates the amount of hzUSD liability reduction needed to restore CR to ~140%

- Burns hzUSD from the Stability Pool

- Mints equivalent bullHYPE to Stability Pool holders

- Reduces system liabilities, improving CR

exitRecoveryMode() Function:

- Available when CR recovers to ≥ 150%

- Converts bullHYPE held by Stability Pool back to hzUSD

- Restores normal Stability Pool composition

This mechanism ensures the protocol can autonomously defend its peg without requiring external intervention.

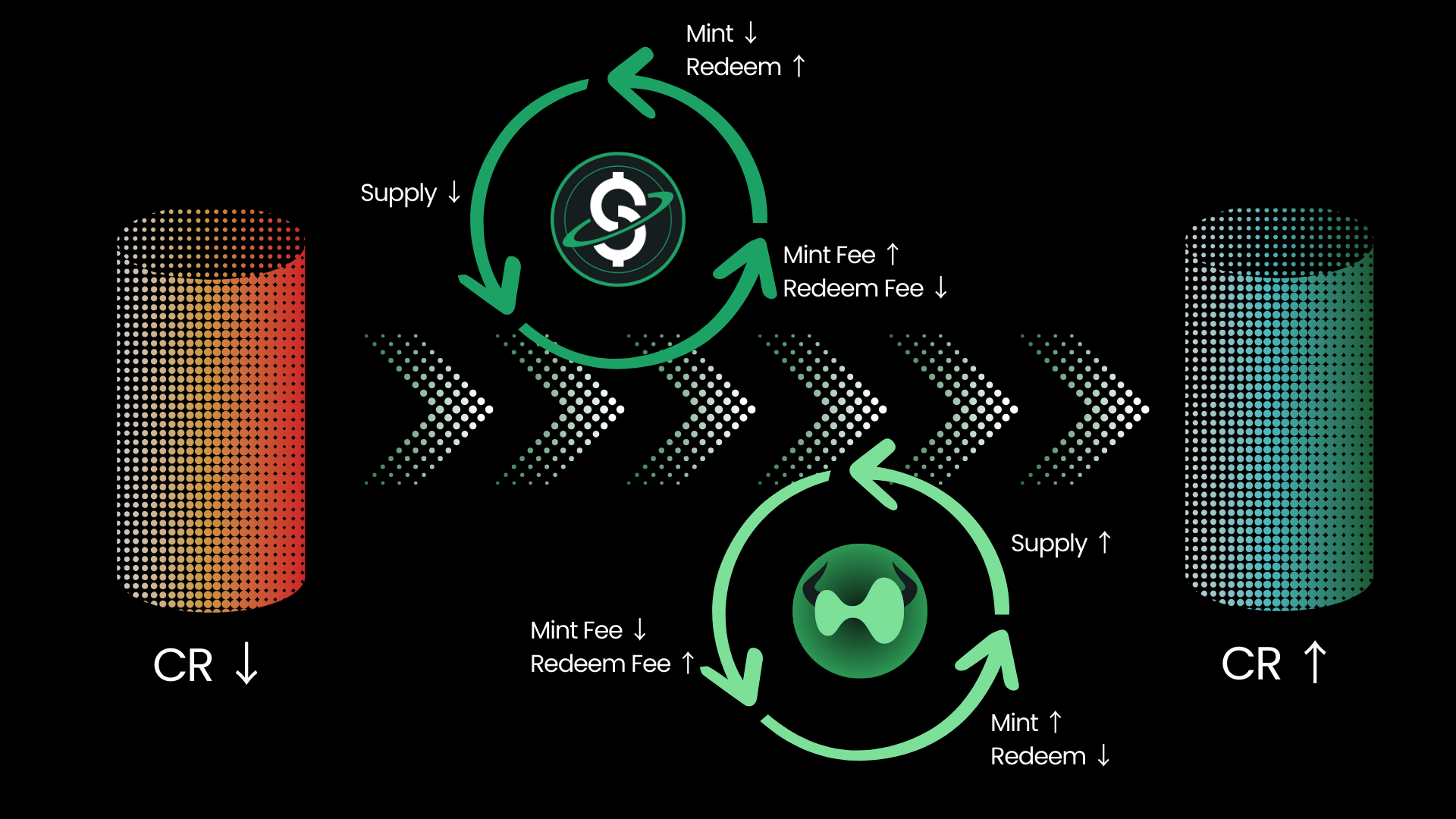

6. Autonomous Stability Loop

The Hyper Stability Module forms a self-stabilizing feedback loop through token-specific fee incentives:

hzUSD Stability Loop

bullHYPE Stability Loop

Stability Pool Intervention

When CR < 130%:

Through this feedback control, the peg is maintained without external operations.

7. On-Chain Operation

- Zone transitions are executed automatically via

_updateSystemState()after each mint/redeem operation. - All state changes emit

SystemStateChanged(uint8 newState)events for monitoring. - Emergency alerts emit

EmergencyStateActivated(uint256 cr)when CR falls below 100%. - Each ratio is verifiable through view functions (

getSystemCR(),getCurrentFee()).